Ladder Up Free Tax Site Opens Today February 1, 2020 at Thurgood Marshall Library

Published: February 1, 2020

Through its Tax Assistance Program (TAP), Ladder Up offers free electronic preparation and e-filing of individual income tax returns for Chicago-area taxpayers. By leveraging the donated time of 1,000+ volunteers, many recruited from the area’s top companies and universities, Ladder Up provides free tax assistance from February – April.

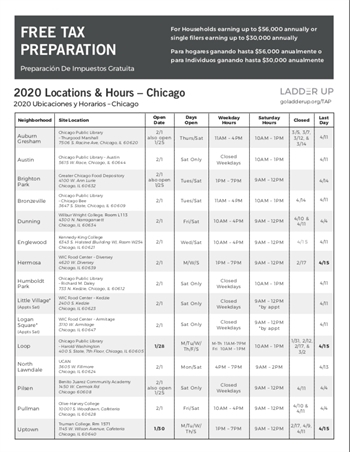

Information for the 2020 tax season with service locations and hours can be found on our TAP client flyer. All tax sites open for business on Saturday, February 1. Most tax sites will continue to offer service dates until early April, with some select sites offering continuing service until April 15, 2020. Please check the locations page website during the tax season for updates and weather-related closure announcements.

TAX ASSISTANCE PROGRAM SERVICES

By using the free services offered through the Tax Assistance Program (TAP), Ladder Up clients can keep more of their hard-earned money.

Since 1994, Ladder Up has prepared over 593,000 returns and secured more than $1.2 billion in tax refunds to clients.

Free services available through the Tax Assistance Program (February 1 – April 15) include:

- Preparation of Federal and Illinois income tax returns for full-year Illinois residents*

- E-file services for tax returns

- ITIN application/renewal assistance (Individual Taxpayer Identification Numbers are needed for taxpayers that do not have and are not eligible to receive Social Security numbers)

- Preparation of prior-year tax returns (for up to 2 previous years plus the current tax year during the regular tax season)

- Preparation of amended returns at some service locations (some restrictions apply, and all tax situations for the client must be in-scope for VITA and Ladder Up). Clients must call 312-588-6900 to make an appointment for an amended return (1040X and/or Form IL-1040-X)

*For clients who are in-scope for our services, we can prepare a federal tax return and a state tax return where one of the following requirements is met:

- Clients were full-year Illinois residents with income only in Illinois for the tax year – in this situation, the state return can be prepared at all TAP locations (Ladder Up does NOT prepare state tax returns for residents of other states, or for partial-year Illinois residents)

- Full-year Illinois residents who had income from Indiana during the tax year can also be prepared at select locations (Loop, Pullman, Southland)

- Full-year Illinois residents who had income from Wisconsin during the tax year can also be prepared at select locations (Loop, Waukegan)

INCOME LIMITS

- Tax Assistance Program (TAP) sites serve individuals earning up to $30,000 per year and families earning up to $56,000 per year.

ELIGIBILITY REQUIREMENTS

*If you do not meet our eligibility requirements for in-person services, you can file for free online using IRS Free File: goladderup.org/freefile

- TAP can e-file the 2019 or 2018 tax return of any client that is eligible to e-file and that wants to submit their tax return electronically instead of through the mail. Previous and current years can also be paper filed.

- Married taxpayers filing a joint tax return must BOTH be present at the site so that Ladder Up can validate proof of identity and Taxpayer Identification Numbers and so that both spouses can sign their tax return following the quality review process. If both spouses cannot be present at the site at the same time, as long as they both come to the tax site during the same session at some point before the site is closed to review and sign the return and e-file signature pages, then the tax return can be released to them and e-filed.

- However, the tax return cannot be e-filed, nor a copy provided to the taxpayer(s) until:

- Both signatures are secured on the tax return or on Form 8879, IRS e-file Signature Authorization, OR

- The spouse has an original copy of a signed and notarized Power of Attorney

OUT-OF-SCOPE: INELIGIBLE INCOME/EXPENSES

TAP can NOT prepare or amend returns for clients in the following situations:

- Clients with income from rental property

- Clients who receive Form 1099-A (Acquisition or Abandonment of Secured Property)

- Clients who receive Form 1099-C (Cancellation of Debt) for discharged debt other than credit card (Box 4), and/or that shows interest (Box 3), and/or that has Code A (Box 6) showing that the client was insolvent at the time the debt was cancelled

- Clients who are in bankruptcy, even if Box 6 on the Form 1099-A/1099-C is not marked with Code A

- Clients who lived or earned income outside of the state of Illinois

If you own your own business, TAP cannot prepare your return if you:

- Had business expenses of more than $25,000

- Did not use the cash method of accounting

- Had an inventory at any time during the tax year

- Had a net loss from the business

- Had employees during the year

- Were required to file Form 4562, Depreciation and Amortization, for your business

- Deduct expenses for business use of your home

A more complete list of additional forms and tax situations that are also Out-of-Scope for VITA and Ladder Up is available here.

If you are out-of-scope for Tax Assistance Program services, click here for IRS tips and resources on how to search for a tax preparer.

A directory of federal tax return preparers is available here.

WHAT TO BRING

Please note: Unless indicated as an Appointment Site (denoted on the TAP locations page), our tax sites offer free tax preparation on a first-come, first-served basis.

Tax Sites will close when they reach capacity. This is often much earlier than the publicized closing time, so please arrive early.

Please plan to be at the tax site for 2-4 hours to have your taxes completed.

PERSONAL IDENTIFICATION

- Original Social Security card (or ITIN card/letter) for yourself and ALL individuals that appear on your tax return

- If Married Filing Jointly, BOTH spouses must be present to have the return prepared

- Photo identification for yourself and your spouse (if you are filing a joint return)

- Birthdates for all individuals that appear on your tax return

Ladder Up’s policy is that the taxpayer(s) themselves should be present during the tax preparation process and when the return is reviewed and signed (especially if the client would like to e-file). If the taxpayer is not present, a third-party individual can only file on behalf of the absent taxpayer only if the third-party individual presents an original, signed, and notarized Power of Attorney that demonstrates that the individual has the power to act on behalf of the taxpayer on financial matters relating to filing and signing a tax return.

BANK ACCOUNT INFORMATION (IF YOU USE A BANK ACCOUNT)

- Account number for your checking and/or savings account

- Routing number for your bank or credit union

Note: If you have a checkbook or a voided check, we will have enough information to allow for direct deposit of your tax refund (if you are eligible for a refund)

- If you do not have either of these, Ladder Up can assist you in opening up a reloadable pre-paid CFR Card which can be used to deposit your refund

INCOME & EXPENSE DOCUMENTS

All income statements received for 2019 (or the tax year you wish to file)

Examples:

- Form W-2 (Ladder Up will not accept payment stubs in place of the W-2)

- Social Security benefits statement SSA-1099

- Form 1099-MISC

- Form 1099-G

- Form 1099-R

- Form 1099-INT or DIV showing dividends paid or interest earned

NOTE: If you are still waiting on missing income documents, please do not come to a tax site site until you have received ALL of your documents.You may need to contact your employer if you have not received your W-2 form by the end of January. Recent IRS processing changes have resulted in refund freezes lasting an average of 11 weeks for taxpayers for file without all of their income documents.

EXPENSE INFORMATION FOR 2019

Some of the things that you paid for during the tax year are deductible. If you had any of the following, make sure to bring the appropriate tax document with you to the tax site. This includes:

- Mortgage interest statement (Form 1098)

- Second (or final) bill for property taxes paid

- College Tuition and expenses for yourself or a dependent (Form 1098-T), student account transcripts, and other records related to amounts paid for college

- Student loan interest paid (Form 1098-E)

- Job-related expenses (if you are a sole proprietor or self-employed)

- Child care expenses (Social Security Number or Tax Identification Number of the caretaker is required)

- Your tax return from the previous tax year (if available)

IF YOU DRIVE FOR UBER OR LYFT:

Uber and Lyft keep records for some, but not all, of the business expenses you may have had.

Both Uber and Lyft have tax summaries available through online driver profiles.

To find it:

- Log into your Uber app

- Go to Help – “How to Update Account”

- Click on the link to Partners.uber.com

- Go to the “Tax Information” tab

- You will want to download the 2019 Tax Summary as well as any Form 1099-K or Form 1099-MISC listed

- Keep copies of all of these pages for your tax records

The Tax Summary does not include ALL expenses. Additional expenses may include:

- Additional miles: Miles driven between fares

- Additional tolls: Tolls paid without a passenger in the car while en route to pick up a fare

- Cell phone: The portion of the use of a phone for business is deductible. This includes the cost of the phone itself as well as the related service contract. The portion of use that is designated as personal is not deductible.

- Refreshments/Amenities for passengers: Refreshments and other supplies such as phone chargers/adapters for passengers are deductible.

- Read more here:

If you need in-person help with obtaining these documents, you can visit one of the locations below.

Uber Greenlight Hubs

Hours vary by location; go to uber.com/drive/chicago/contact/ for complete information

- 4609 W. Belmont Ave., Chicago

- 1401 W. North Ave., Chicago

- 839 W. 115th St., Chicago

- 7250 S. Cicero Ave., Bedford Park

Lyft Hub

3976 N. Avondale Ave., 2nd fl., Chicago

Mon & Wed, 10 am-8 pm

Tue, Thur, Fri, 10 am-4 pm

HEALTH INSURANCE INFORMATION

Examples:

- Proof of health insurance coverage (i.e. Form 1095-A, Form 1095-B, Form 1095-C, Medicare card) OR

- Certificate of Exemption

WHAT TO EXPECT

Most tax sites operate on a first-come, first-served basis. Tax Sites will close when the site reaches capacity, so arrive early if possible.

To make an appointment at one of the appointment-preferred locations, please call (312) 588-6900 during regular business hours or visitwww.goladderup.org/locations to see a list of appointment-preferred locations.

Here is an overview of the tax preparation process at a TAP site:

- Once you arrive at the tax site, we will ensure that you have original Social Security/ITIN card(s) for everyone on your return, photo ID, and that you meet basic eligibility requirements. If you are Married Filing Jointly, BOTH spouses must be present to have their return completed.

- After we verify your ID and SSN, we will put your name on the list for the day and give you the intake paperwork to complete. This includes an IRS Form 13614-C, and some Ladder Up paperwork as well. If you show up after capacity has been reached, we may add your name to a wait list or ask you to return to the site another day. (Tax Sites will close when the site reaches capacity, so arrive early if possible.)

- A Case Reviewer will review your paperwork and ask you more specific questions regarding your tax documents and tax situations to determine whether you are eligible for service. If you are eligible, you will receive a numbered index card.

- When your index card number is called, you will sit with a Tax Preparer who will prepare your return.

- After the return has been prepared, you will receive a blue numbered index card and asked to return to the waiting area.

- When your blue index card number is called, you will sit with a Quality Reviewer who will review your return for accuracy as a second set of eyes.

- The Quality Reviewer will finalize your return, review the results with you (including amount owed or refund), provide you with a printed copy of your return for your records, and discuss next steps if necesarry.

GET LEGAL TAX HELP

GOT A LETTER FROM THE IRS?

Don’t panic! We know that having a dispute or problem with the IRS or Illinois Department of Revenue can be expensive and confusing if you don’t have the right help. Our Tax Clinic provides free assistance to help you with resolving your tax issues.

COMMON TAX ISSUES

Audits

If the IRS or Illinois Department of Revenue believes that there are errors on your tax return, you may be audited. During an audit, you are required to prove that you qualify for the deductions and credits claimed on your tax return. We can help you understand which documents the IRS or Illinois Department of Revenue requires and, if needed, we can represent you during the audit.

Past-Due Tax Returns

Depending on your income and filing status, you may be required to file past-due tax returns. Please note, our Tax Clinic can help you prepare and file these past-due returns only if you have received a letter from the IRS or Illinois Department of Revenue requesting them. For all other past-due tax returns, you may be eligible to receive assistance at one of our Money Action Days.

Collections

If you owe money to the IRS or Illinois Department of Revenue, they can garnish (levy) your wages or Social Security benefits, levy your bank account, or file a lien—all actions that can make it difficult to maintain good credit. If you disagree with the amount that the IRS or Illinois Department of Revenue says you owe, CEP can investigate and work to correct it. If you agree with the amount you owe, CEP can help you set up an affordable payment arrangement.

Learn more: I Owe a Tax Debt: What are My Payment Alternatives? (Spanish, Chinese, Polish)

Employee vs. Independent Contractor Disputes

Some employers improperly classify their workers as independent contractors rather than employees. At tax time, the affected workers often find themselves owing more to the IRS than expected. If a worker has improperly been classified as an independent contractor, we can work with the IRS to have the classification corrected.

Learn more: Are You an Employee or an Independent Contractor? (Spanish, Chinese, Polish)

Innocent Spouse

When spouses file a joint tax return, both spouses are jointly and severally liable for the information on the return. The IRS can pursue one or both spouses for the entire tax debt shown on a tax return, even if the debt is caused by only one of the spouses. In some circumstances, CEP can file a request asking the IRS to release the “innocent spouse” from this joint and several liability.

Learn more: Tax Relief for Divorced and Separated Taxpayers (Spanish, Chinese, Polish)

Cancelled Debt

The IRS generally treats canceled debt as taxable income that must be reported on your tax return. Typical examples include canceled credit card, mortgage, or car loan debt. However, in some circumstances, this “cancelation of debt” income may properly be excluded from your taxable income. We can help determine whether you qualify for this exclusion and amend prior year tax returns, if needed.

Learn more: Do You Have Cancelled Debt?

QUALIFYING FOR TAX CLINIC SERVICES

Our Tax Clinic helps low income individuals and families who have a controversy with the IRS or Illinois Department of Revenue and who would like to dispute their liability or negotiate affordable payment arrangements. You can qualify for a Tax Clinic representation if your current household income is less than the following thresholds. Add $11,050 for each additional family member over 8.

| Family Size |

Income No More Than |

| 1 |

$31,225 |

| 2 |

$42,275 |

| 3 |

$53,325 |

| 4 |

$64,375 |

| 5 |

$75,425 |

| 6 |

$86,475 |

| 7 |

$97,525 |

| 8 |

$108,575 |

ITIN INFORMATION

(Servicios de ITIN)

Ladder Up can help taxpayers apply for and renew an Individual Taxpayer Identification Number (ITIN) by providing free assistance with completion of Form W-7 (Application for IRS Individual Taxpayer Identification Number).

If you would like to make an appointment to complete your ITIN application, please use our contact form below and select “ITIN Assistance” from the dropdown menu.

For a detailed flyer about Ladder Up’s ITIN services, please click here.

For your appointment, please bring a passport OR any two of the following documents:

- United States Citizenship and Immigration Services (USCIS) Photo Identification

- Visa issued by United States Department of State

- United States Driver’s License

- United States Military Identification Card

- Foreign Driver’s License

- Foreign Military Identification Card

- National Identification Card (must be current and contain name, photograph, address, date of birth, and expiration date)

- United States State Identification Card

- Foreign Voters Registration Card

- Civil Birth Certificate (required for applicants under 18 if passport is not provided)

- Medical Records (valid only for dependents under age 6)

- School Records (valid only for dependents under age 14 (under age 18 if a student))

WHERE’S MY REFUND?

To check on the status of your federal refund, please visit: https://www.irs.gov/refunds

You will need the following information:

- Social Security number or ITIN

- Filing status

- Refund amount (Line 76a of your Form 1040)

If your search does not return a result, please reach out to TAP to check on the status of your return by calling 312-409-1555.

To check the status of your Illinois state refund, please visit: https://mytax.illinois.gov/

RESOURCES

Internal Revenue Service (IRS)

www.irs.gov

(800) 829-1040

(800) 829-4059 (TDD)

Social Security Administration

www.ssa.gov/chicago

(800) 772-1213

Illinois Department of Revenue

tax.illinois.gov

(800) 732-8866

(800) 544-5304 (TDD)

Local Illinois Department of Revenue Offices:

James R. Thompson Center – Concourse Level

100 W. Randolph St.

Chicago, IL 60601-3274

(800) 732-8866

Maine North Regional Building

9511 Harrison Ave.

Des Plaines, IL 60016-1563

(847) 294-4200